While conservatives and neo-liberals champion the power of the American free market, the recent GameStop frenzy indicates that the market isn’t as free as they would like to believe, and that Wall Street is inherently flawed.

Reddit, a popular forum-based site, created quite a controversy Jan. 28. The subreddit, r/wallstreetbets is one of the many Reddit forums, in which people discuss stocks and investments. GameStop, a company that sells video games, was at risk of bankruptcy due to slow sales during the pandemic. Hedge fund managers had planned on short selling GameStop. A great number of people on the r/wallstreetbets bought shares of GameStop, alongside other companies like AMC, which raised its share price dramatically.

This raise, known as a “short squeeze,” causes the short sellers to buy the stock before the price gets too high to minimize future losses. Hedge funds reportedly lost approximately $19 billion Jan 29, after they were forced to buy back shares at a higher price.

After these series of events, Robinhood, a financial services company people often use to trade stocks, decided to halt trades in GameStop. Some criticized this move, viewing it as a way to manipulate markets and decided to take a lawsuit against the company.

Halting trades when non-elites attempt to seek control of the stock market shows that the United States market is not as free and democratic as it claims to be. The market has always been made to benefit wealthy Wall Street bankers, rather than ordinary Americans.

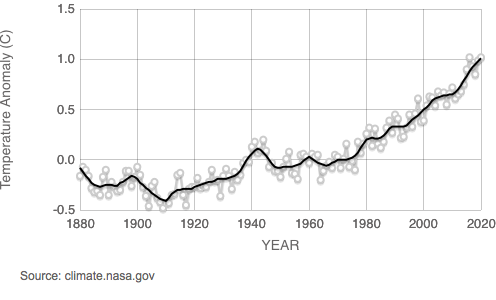

In addition, the volatility of the stock market shows that its structure is fraudulent and fragile. The economic model can be likened to a gambling casino. The failures and frauds of Wall Street are not a unique phenomenon, and its faulty operations have been noted a decade earlier, such as when Goldman Sachs defrauded clients in 2010. Side bets take place without raising money for industry. Instead of investing, gambling on the successes and failures of companies and mortgage bonds without actually creating mortgages.

The United States’ biggest banks, like JP Morgan and Chase, heard a majority of the country’s wealth, more than half of the nation’s GDP. Trusts and monopolies limit choices and hurt consumers, and the country’s economic stability is wagered on their performance.

The GameStop situation just further proves that the U.S’s economy is a joke. Stocks are portrayed as something any “ordinary Joe” can partake in and revel in its glory, but when that does occur- like with GameStop- and it inconveniences the 1%, regulations are suddenly deemed necessary. Poor and middle class Americans are being constantly told to “pull themselves up from the bootstraps” and that their low financial status is often a result of laziness, yet this proves that economic mobility is just another fantasy made up by the billionaire class.

Wall Street has always been a place filled with greed and will continue to be if it is not broken up and taxed. Economists and politicians have argued that a transaction tax on trades would limit the amount of wealth earned by hedge fund managers and high speed traders.

The tax would not just help reduce Wall Street’s dominance and concentration of the U.S’s wealth, but also be used to fund programs that benefit middle- and working-class Americans. For example, the Wall Street taxes can be used to make college and universities free, and cancel student debt, which averages $32,731 per loan borrower.

The market is not free. Trading was never meant to be an equalizing force amongst Americans. Everyday, it becomes more abundantly clear that the billionaire class composed corporations and banks serve as an oppressive force and operate as a sort of proxy government. The solution is not to deregulate the market as some libertarians propose, but rather completely dismantle Wall Street’s current dishonest ways of operation.

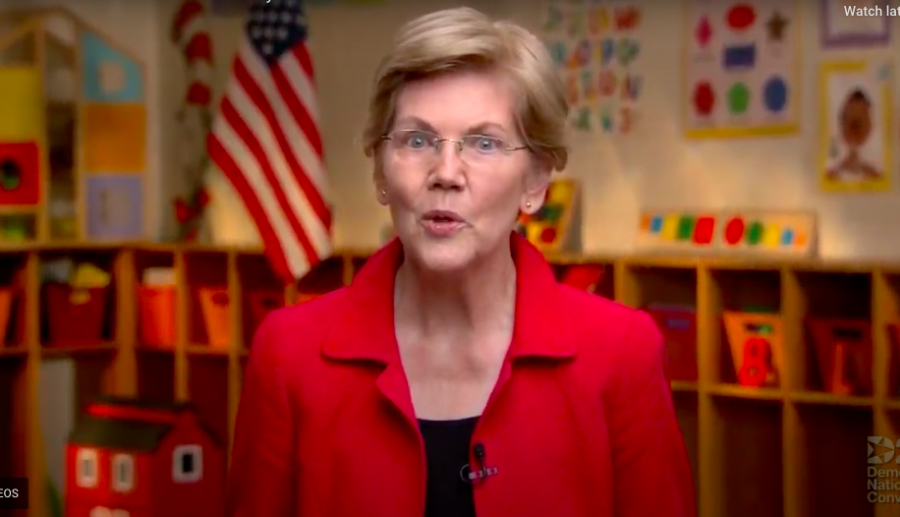

The Democrats now hold executive office as well as the occupy a large portion of the House. Many Democrats, such as Sen. Elizabeth Warren, and Rep. Alexandria Ocasio-Cortez have advocated to hold the market accountable and increase transparency. It is now up to them to not side with the regulatory forces of Robinhood, but to come to terms with the fact that Wall Street is phony and fraudulent, and as it stands, must be significantly reformed.

This story was written by Lucia Ruffolo. She can be reached at [email protected]

Kelly Miller • Feb 9, 2021 at 5:08 pm

The problem with a transaction tax is it hits retirement accounts too. I am a low middle class single mother. The only retirement savings I have are in my IRA account. These accounts need to be kept totally TAX FREE for the middle class. We have nothing to do with Wall Street. I work 2 jobs. One clerical and one retail. Dont go thru with this tax. It hits everyone. Including me.

Thank you-

Kelly Miller