College is the first time many students experience independence in making financial decisions, which can lead to ill-advised and unsustainable spending habits. These students will eventually need to learn how to budget, track expenditures and manage savings, especially in their lives after graduation. Marquette should consider implementing a required financial literacy course to ensure students are comfortable managing their money.

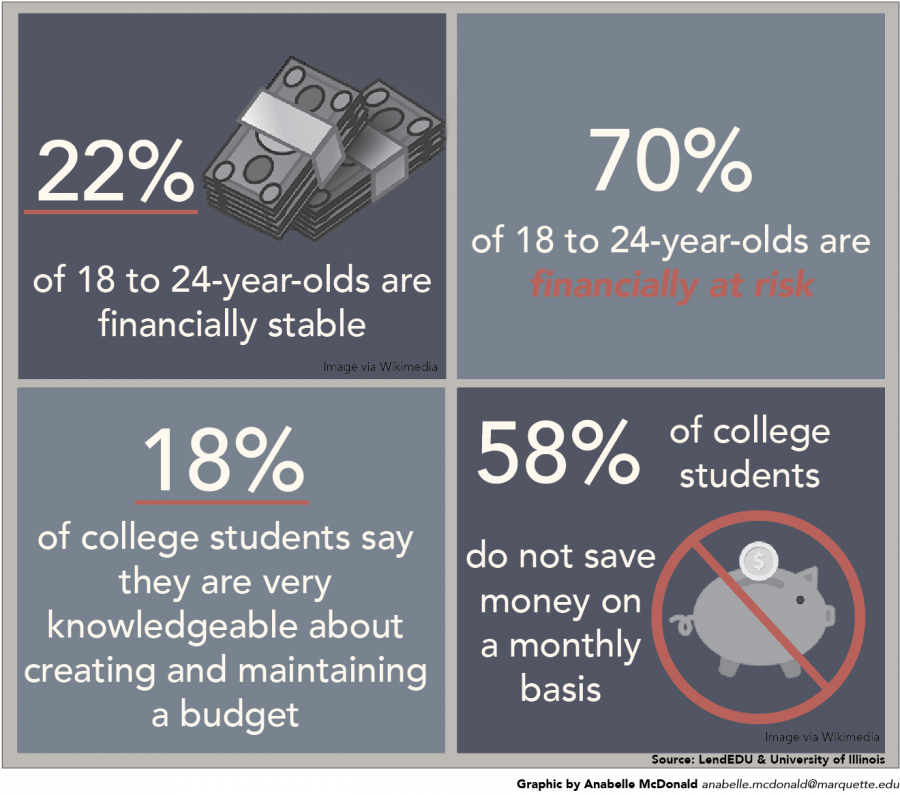

New research from the University of Illinois emphasized the distressing economic circumstances that many young adults are currently experiencing. The study deemed only 22 percent of 18 to 24-year-olds as financially stable. In contrast, nearly 70 percent were considered financially precarious or financially at risk. These groups were more likely to default on credit cards and use alternative financing services, such as payday loans, which charge high interest rates and fees so recipients can receive a short-term cash boost.

This trend is likely exacerbated by a lack of skills in budgeting and expenditure tracking. Only 18 percent of college students reported that they were very knowledge about creating and maintaining a budget, according to a survey by LendEDU, a financial advice website. In addition, more than 40 percent of students said they don’t track their monthly spending, while 58 percent reported not saving money each month.

One of the most common debt traps for college students is poor credit card choices. Most college students have a limited understanding of credit card terms and conditions. Many students may not know how to manage these cards, which hurts their overall financial well-being, according to research from Montclair State University. Despite this limited knowledge, many students still appear nervous about the potential negative impact of their credit card usage. About one-quarter of college students with a credit card worry that their card debt is out of control, with these students averaging a balance of $1,454, according to consumer banking corporation Sallie Mae.

A required financial literacy course could get students on track for making better spending choices. University faculty can look to the University of Wisconsin-Madison, which currently offers a Financial Life Skills program in its School of Human Ecology. The program was ranked as one of the best in the nation for financial literacy in 2018 by LendEDU.

The Financial Life Skills program consists of two one-credit classes that teach students topics such as how to budget, file taxes, use credit cards and manage debt. One of the classes is specifically focused on monetary decisions after graduation, including purchasing a house or car, planning retirement savings and buying insurance. While the program is not a requirement at UW-Madison, Marquette should consider adding a similar set of courses to the core curriculum, as the skills learned in these classes have significant real-world applications for every graduate.

In adding these courses, Marquette could make up for the lack of quality financial skills education at the high school level. A 2018 report from the Brookings Institute found that only 21 states require high school students take a financial literacy course to graduate, and Wisconsin is notably absent from this list. The report also found that states vary greatly in the amount of time and quality of instruction they devote to financial literacy. Marquette has the tools and resources to significantly outperform the level of instruction of high school classrooms in this area.

Marquette should require financial literacy courses to ensure that students are able to independently and effectively manage their money. These courses will help students stay out of debt, as well as lessen concerns about major monetary events and decisions after graduation.