In an uncommon move, the university took an explicit stance against a piece of legislation: the recently-proposed Republican tax bill. The statement urged community members to contact their congressional representatives because the bill could have potentially harmful effects on the university.

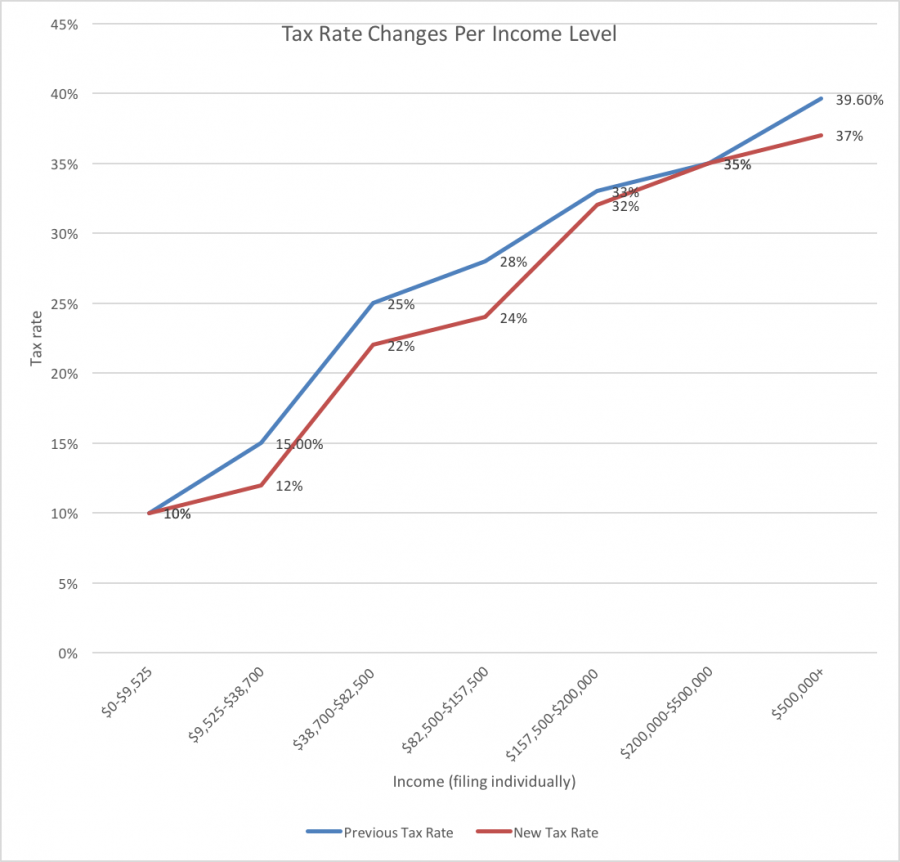

The bill, which went through preliminary voting in the House Nov. 6, proposes cutting the corporate tax rate from 35 to 20 percent. The deficit created by that cut would be made up with money from other areas, which includes new taxes on private university endowments and charitable giving.

The potential cost of the bill was too high for the university to remain silent, university spokesperson Brian Dorrington said.

“It became clear that provisions of the proposed reform will dramatically impact current and prospective students as well as their families,” Dorrington said.

Endowment tax

The bill would impose a 1.4 percent tax on private university endowment earnings, which the university uses to help students cover education costs aside from tuition.

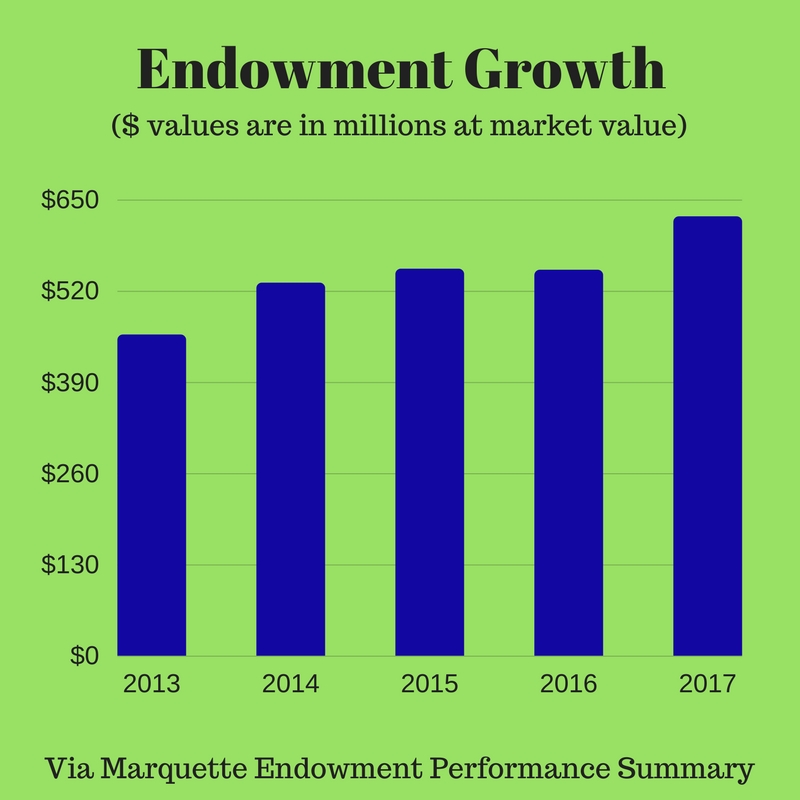

Marquette does not qualify for that tax because their endowment is less than $100,000 per student. To qualify for that tax, the endowment would have to reach approximately $1 billion. The university endowment sits at around $626.2 million, up from $550 million in the fiscal year 2016, according to the Endowment Performance Summary. That number is likely to continue to rise as the university pushes for many recently proposed projects.

During Monday’s committee meetings, an amendment was introduced by Texas Republican and House Ways and Means Committee Chairman Kevin Brady. The amendment would move the endowment threshold to $250,000 per student. This change would make it significantly more unlikely that Marquette would ever reach that amount. The endowment amount would have to triple from the original threshold in the bill, up to three billion.

That proposal is one of a few changes suggested during Monday’s meeting, and more are expected to come in the following days of deliberation.

“1.4 percent may not seem like much, but consider that the university spends approximately four to five percent of the endowment fund each year,” James McGibany, an associate professor of economics in the College of Business Administration, said. “The university is currently working on advancing the endowment to a point where we would be pushed into the range of this new bill.”

Potential effects

The bill would double the standard deduction for those filing their taxes jointly, which means there are fewer deductions to be taken from charitable donations to the university.

“The potential for people to donate less because they know less of the money will actually go to the university exists,” McGibany said. He gave an example: If every dollar given really only results in 67 cents going to the university, that affects big donors. There would be less incentive to give money if firstly, less of it would go to the university, and secondly, it wouldn’t be tax deductible.

In addition, the bill would make previously tax-exempt tuition taxable. For masters and doctoral students who receive at least parts of their tuition from working as teaching assistants or research assistants, this means the money that goes from the university to pay their tuition in exchange for their work would be considered part of the student’s income.

If the money the university is using to pay the student’s tuition was considered the student’s income, the student would be stuck paying potentially large amounts of taxes on money that isn’t actually coming from them.

Some faculty fear this could deter students from seeking graduate degrees at a time when graduate students are already in short supply.

“The bigger impact would be on graduate students and not as big of an impact to the endowment,” said Abdur Chowdhury, a professor of economics in the College of Business Administration and former chief economist of the United Nations Economic Commission in Europe.

Purpose of the bill

The reason for this bill, as given by House Speaker and Wisconsin congressman Paul Ryan is, “With this plan, we are making pro-growth reforms, so that yes, America can compete with the rest of the world,” as stated at a press conference when the bill was announced.

The bill proposes cutting America’s corporate tax from 35 to 20 percent, so the money gained from increasing taxes on institutions like Marquette would make up for that cut. McGibany said that America has one of the highest, if not the highest corporate tax rate in the world, and there is evidence countries with lower corporate tax rates have higher wages following cuts being made.

But, political science professor Paul Nolette, whose research focuses on federalism and how it interacts with politics, said the tax rate only looks to be one of the highest tax rates on paper, when that number does not include the many corporate tax breaks that exist. In reality, most corporations never pay close to that amount, Nolette said.

“I wouldn’t be surprised to see some modest increases in wages, but on the other hand, I wouldn’t be surprised if a lot of it went to corporate leaders,” Nolette said.

Why increase taxes on private educational institutions

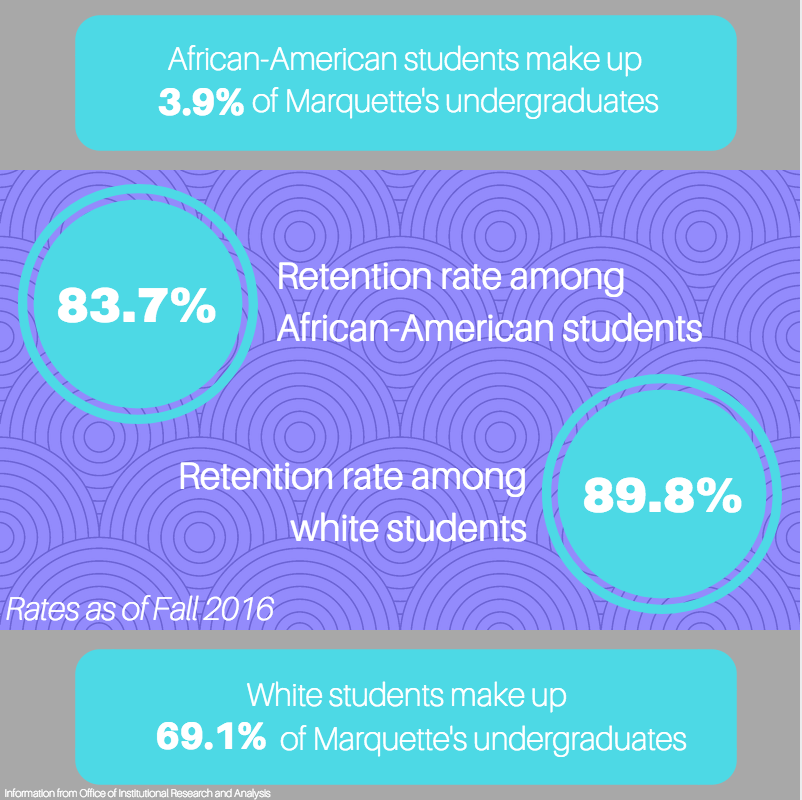

Of all the areas to increase taxes to make up for the corporate cuts, higher education is high profile. Part of the reason for targeting private schools is because they tend to attract wealthier students, Chowdhury said.

Additionally, “It is easier to tax private institutions because you don’t have to go through state legislations,” Chowdhury said.

Nolette said politically, some of the reason may be that higher education institutions tend to lean democratically.

“Republicans have no issue taking on higher educational institutions because it’s not as many of their constituents that would be affected,” Nolette said. “In fact, it might be politically smarter because private schools don’t make up as large a group as, say, the housing market to increase taxes on. There are much less people affected.”

Bill not likely to pass soon

The GOP is hoping to pass the reforms by Christmas. The university is in contact with congressional representatives and is working alongside state and national associations, according to their statement.

Duane Swank, a professor in the political science department who studies political economics, said the bill is not likely to be passed by the timeline the Republicans have set, and that passing a bill this large in such a small timeframe is uncommon. The last tax bill of such magnitude to pass through Congress took place during the Reagan administration, and those changes were debated over and instituted over a series of multiple years.

“It’s important to keep in mind that passing bills like this requires building bipartisan coalitions. That will be hard in the current political climate, so there is a lack of evidence that it is even possible for the time being,” Swank said.

Swank added that private universities such as Marquette are just one group who would be adversely affected by the bill, and there is likely to be large pushback and lobbying from many groups.

Nolette said the reason for rushing this bill may have something to do with 2018 being an election year. “In the year since the current administration has held power, Congress has not passed any significant pieces of legislation, and they want this as a talking point for the upcoming elections,” Nolette said.

The bill will go through preliminary votes in committee this week as it goes through the markup process before ever seeing an actual vote to make it law. There are only around 20 legislative days left in the calendar year 2017.