With a vote on the new Republican-proposed tax plan to take place Nov. 6, the university released a statement this afternoon via email stating the bill would have “significant negative impacts on higher education, students and families.”

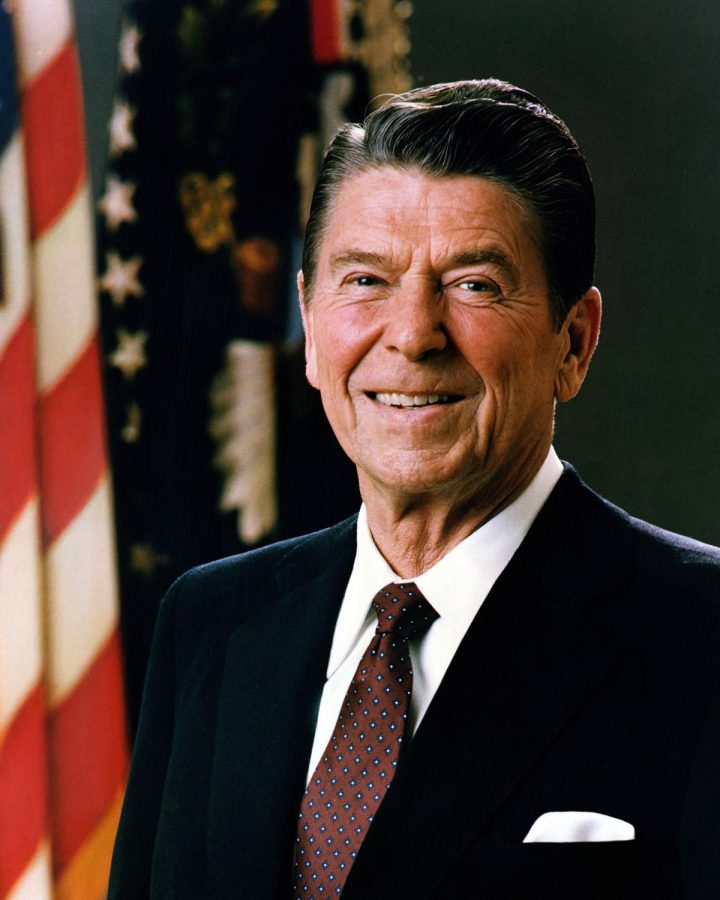

House Speaker and Wisconsin congressman Paul Ryan said at a press conference, “With this plan, we are making pro-growth reforms, so that yes, America can compete with the rest of the world.”

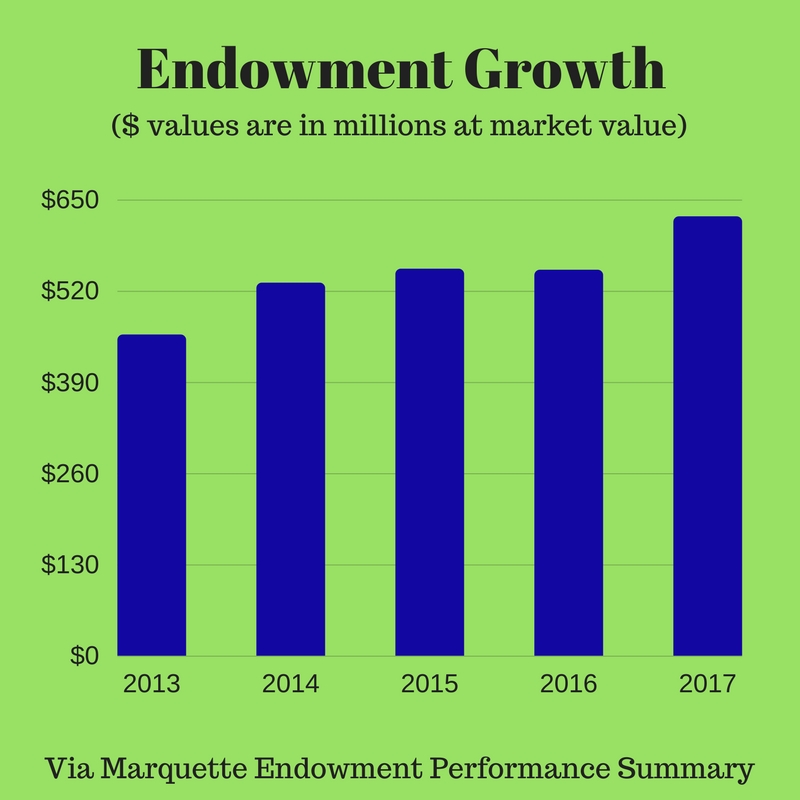

The bill would impose a tax on private university endowment earnings, which the university uses to help students cover education costs aside from tuition.

“Scholarship funding through the prudent distribution of endowment earnings via charitable givings significantly helps decrease costs to students,” the statement said.

Marquette has given out almost $23.6 million in scholarship aid from endowment income and charity, according to the statement.

The proposed bill would impose a 1.4 percent excise tax on private university endowment earnings for institutions whose endowments total at least $100,000 per student, Marquette being one.

Marquette said in a statement that this measure would disadvantage private universities and will negatively affect the next generation of citizens.

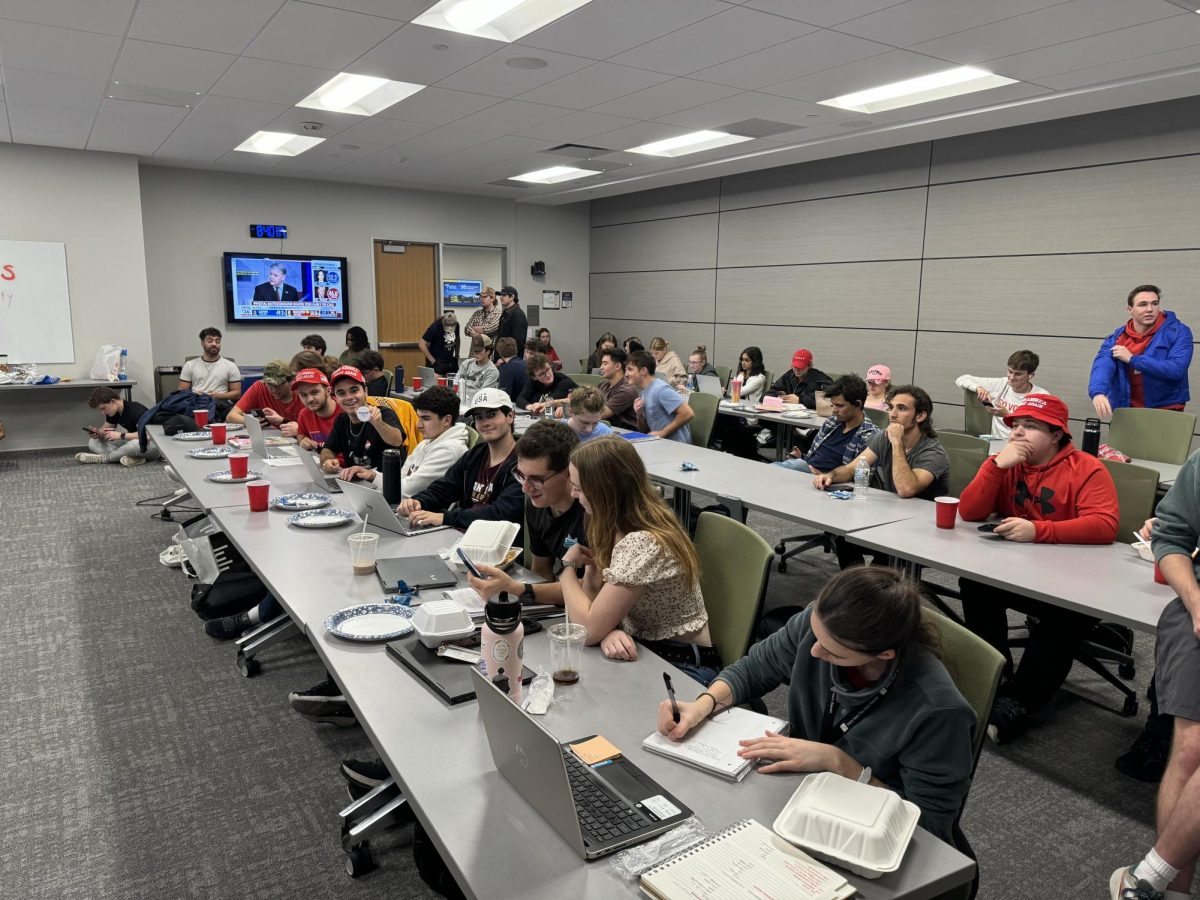

Another feature of the bill would involve taxing previously tax-exempt tuition remissions. This would affect the Marquette employees whose children attend other Jesuit institutions tax-free.

“Nearly 200 Marquette employees currently have dependent children at Marquette or another Jesuit institution who receive a tax-free tuition benefit,” according to the statement. Besides that, another 175 Marquette employees or spouses take advantage of this benefit.

The Republican Party is hoping to pass the reforms by this Christmas. The university is in contact with congressional representatives and is working alongside state and national associations.