Marquette University Student Government hosted a presentation and Q&A about the university budgeting process last Wednesday, facilitated by university leaders.

The event was open to the public and included an overview of where tuition money goes as well as how the money is allocated.

Vice president of finance Ian Gonzalez, senior budget director Jay Kutka and vice president for enrollment management John Baworowsky gave the presentation and then fielded questions.

Gonzalez told attendees not to record audio or video of the event.

The presentation began with a broad overview of the university budget. Gonzalez said the funding for Marquette’s budget is classified into three major categories: unrestricted, restricted and other. Some components that go into the unrestricted category, Gonzalez said, include operations that primarily factor in tuition, room and board, and sales and service. The restricted subset of the budget is made up primarily by donors and scholarships. The ‘other’ section includes debt and grants.

When building the budget, Gonzalez said recruitment of the incoming class plays the biggest role, as this affects financial aid and how much the university can provide for its students. He also stressed the importance of the Marquette Beyond Boundaries program, as it ties into Marquette’s strategic initiatives regarding enrollment, graduate programs and online courses. Beyond Boundaries is Marquette’s strategic plan for campus development.

Along with building the budget through Beyond Boundaries, non-discretionary expenses help to build the budget as well. These are expenses that the university has to pay. Some of the non-discretionary expenses include utilities, interest and contract maintenance.

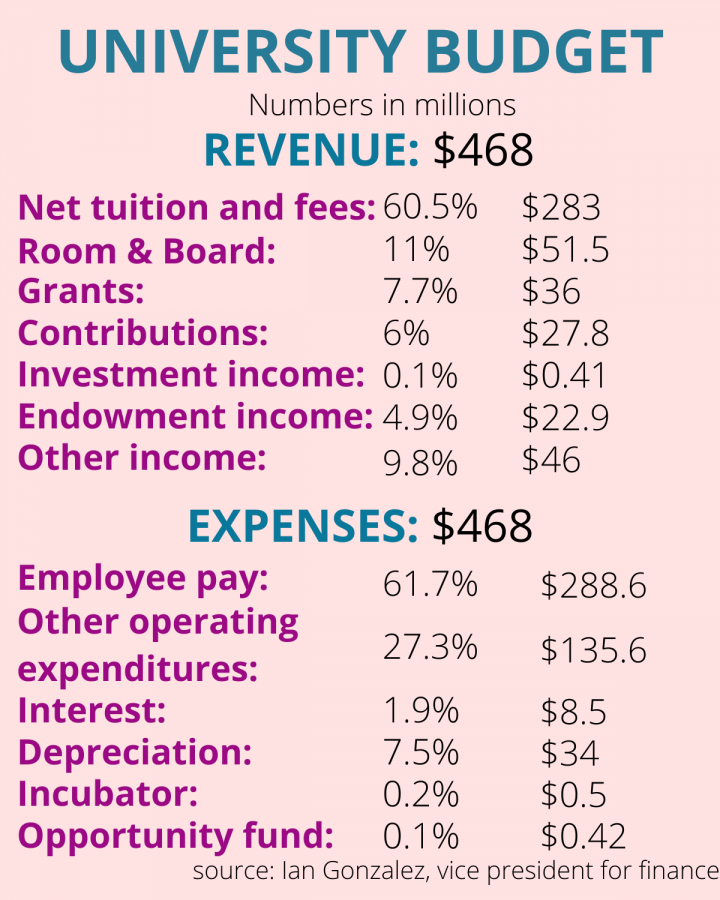

Gonzalez said Marquette is currently operating a balanced budget, as revenues and expenses both equate to $468 million.

“We are in a position of strength right now,” Gonzalez said.

The revenue section is highly dependent on enrollment. The largest portion of the revenue side of the budget is tuition and fees, which represent 60.5%, followed by room and board at 11%. Grants make up 7.7%, while 6% is contributions. Investment income makes up 0.1% and 4.9% comes from endowment income. The rest of the revenue, 9.8%, comes from other income.

On the expenses side, the largest portion is 61.7% as a result of compensation, or employee pay, followed by 27.3% in other operating expenditures. Interest is 1.9% and depreciation is 7.5%. Incubator makes up 0.2% and the opportunity fund makes up 0.1%. Depreciation is the reduction of an asset’s value over time. The Marquette Incubator Initiative is a program that supports “the rapid revitalization and creation of graduate programs that meet student and market needs,” according to Marquette’s website.

Gonzalez also said current challenges that Marquette faces center around enrollment and cost control. With enrollment, the main issue is affordability, while cost control takes into account staff headcount management, which refers to quantifying what each employee does. For example, Gonzalez said that 75 positions were recently eliminated as a proactive measure to move forward as a university. Out of the 75 positions, 50 of them were open positions while the other 25 were currently filled.

Gonzalez added that Marquette has added 34 new scholarships. Financial aid-wise, the five-year financial aid trend shows how the budget has grown every single year from 2015-16 to 2019-20. In 2015-16, the budget for aid was $121,574,000, while in 2019-20 that number is $172,282,000.

The final key statistics that Gonzalez spoke about were how much money Marquette has raised thus far for the new business school and the return on investment that a Marquette education provides. Gonzalez told the audience Marquette has raised $44 million out of $70 million needed.

Dan Brophy, a senior in the College of Arts & Sciences and executive vice president of MUSG, said planning for the event started last November. There was a similar event about freezing tuition by Student Senate, which inspired the event, he said.

Kutka said he feels the budget will continue working well going forward.

“The main reason for this is stability,” he said. “President Lovell is a stable leader, and with stable leadership comes a stable budget and direction.”

John Keefe, a first-year in the College of Business Administration, said he thought the event was interesting.

“It was cool to have the opportunity to hear from some of the people that have a direct impact on the budget and what they had to say,” Keefe said.

This story was written by Nick Magrone. He can be reached at nicholas.magrone@marquette.edu.