Over the past few months, the cost of items has risen due to inflation in the United States. Some of those affected by this rise are families, individuals on a fixed income and in particular students.

“Inflation occurs when the overall demand for goods and services is high (and stays high) relative to the overall supply of those goods and services. The higher or excess demand tends to cause prices to be bid up – and if the problem persists, prices rises leading to inflation,” James McGibany, Chair of the Department of Economics, said in an email.

McGibany said that this issue is not just a national issue, but a global phenomenon taking place in developed nations. He said that this issue is something that individuals will be studying for a long-time due to the fact that there were multiple leading causes during the COVID pandemic that led to this issue.

“The rising costs due to the inflation stressed me out a little bit. When the prices first started increasing, it worried me that it would be harder to afford all my necessities such as food and certain self-care products,” Lema Elkhatib, a first-year in the College of Arts & Sciences, said.

Elkhatib said that this issue had continued to affect not just herself but also her family, who, for a short period, had to become more cautious regarding their spending habits.

Back in February of 2023, the Marquette University Law Poll found that 96% of those polled were worried about inflation and had little faith regarding the legislation being passed to combat the issue.

Mohammed Ahmed, a sophomore in the College of Arts & Sciences, said he has not had to take on debt or any financial obligations due to these rising costs but feels outraged about the cost of most items.

“I’ve had to cut down on meals and going out with friends in order to save money,” Ahmed said.

Elkhatib said that she believes most people affected by inflation are low-income families who rely on welfare programs such as food stamps.

In a poll conducted by NPR back in August 2022, it found that 63% of Native American adults and 55% of Black adults are facing serious financial crisis. A majority of Black and Latino individuals said that they are not able to cover at least one month of expenses.

The poll found that this issue translated to other issues such as healthcare, neighborhood safety, and affordable housing.

“To combat the issues of rising costs, I ended up working a lot more than usual. I tried to cut back on things, but as someone who supports her family, it definitely wasn’t easy,” Amani Dalieh, a sophomore in the College of Arts & Sciences, said.

Dalieh said that this may also affect the parents, who may have other children to financially support but also want to care for their child in college who may be struggling financially during these times.

Elkhatib said that this experience has helped her to be able to manage money better. She now allocates a certain amount of money to save each month, and the other amount she spends on herself.

Some students feel that Marquette should be taking steps to help combat the rise in prices.

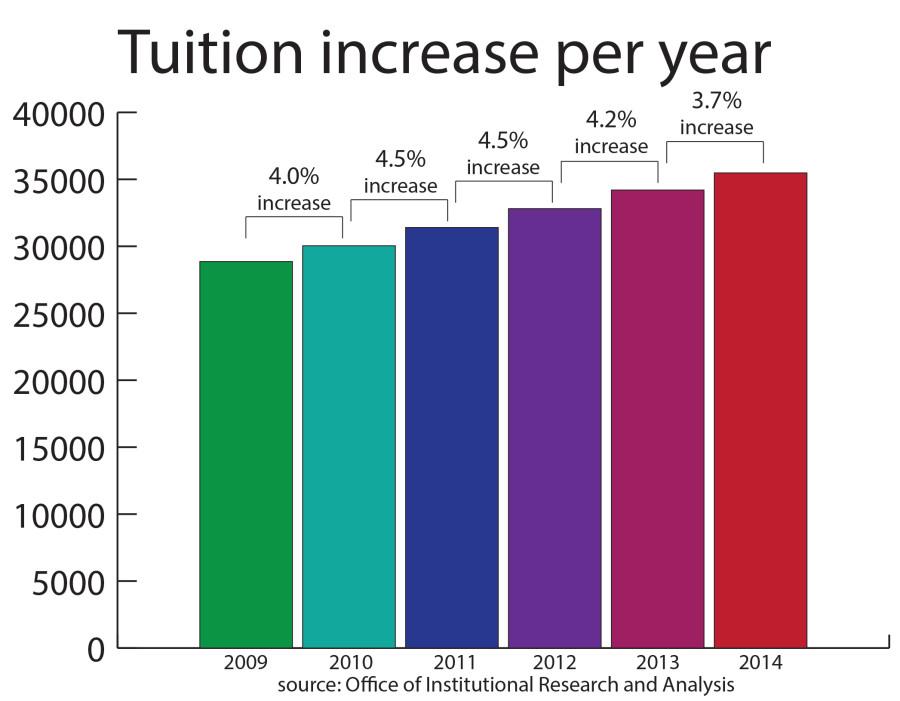

“Lower tuition, not increase it, and provide more affordable dining on campus,” Ahmed said.

Dalieh and Elkhatib said there should be more affordable options for commuter students to purchase food on campus.

Elkhatib said that Marquette should continue giving meal swipes to those in need. She was one of the students who benefited from the Swipe Out Hunger program on campus, which gives out 15 free meal swipes to those already without an existing plan.

Elkhatib said that this helps commuter students like her, especially when there may not be food at home.

With the rise of costs in the United States, some students feel there is hope for the future.

“I think in the long-term prices will just settle down. I’m hoping that the minimum wage increases from $7.25 to at least $10.00. I do have some hope that the inflation will not continue to be as dramatic at it is. This has happened in the past and we have recovered from it before, so I think it’ll be similar to the past,” Elkhatib said.

Dalieh said that raising costs slowly should not be a concern as long as salaries continue to rise. Though she said this should translate to all jobs, not just those that benefit the upper class.

She said there is hope for prices to settle down in the long term and does not think this will continue for an extended period.

As for others like Ahmed, he is less hopeful regarding the future of inflation. He said that he does not see prices going down anytime soon.

“Inflation isn’t a fully bad thing. For the past 50 years or so, the United States has received the ideal limited level of inflation that results from a well-functioning demand economy, where prices increase somewhat each year. The recent price increase is a result of the economy regaining strength,” Dalieh said.

This story was written by Uzair Qhavi. He can be reached at uzair.qhavi@marquette.edu