Current FAFSA requirements have left some students feeling systematically advantaged, while others feel as though it unfairly assesses their financial need.

The FAFSA application closed today per Marquette’s deadline. Dependent students report the financial information of their parents, according to the FAFSA website. FAFSA uses this information to determine the amount a family can contribute to its child’s college education.

This is calculated from the parent’s adjusted gross income and the total is known as the expected family contribution. The process of filling out the FAFSA requires information from both students and their parents that can be obtained from tax returns or the Internal Revenue Service data retrieval tool.

But for students like Mary Webb, a sophomore in the College of Communication, the information from the FAFSA does not tell the whole story about her family’s finances. Webb’s family owns farmland, but there is no monetary benefit from it. Despite this, the FAFSA takes the property’s value into account.

“It doesn’t help me too much because it takes into account my family’s farmland, but we don’t take care of the farmland and don’t take any of the benefit of it — we just own it,” Webb said. “But the rest of my family takes care of it. So it thinks that we have a lot of money from farms but we don’t.”

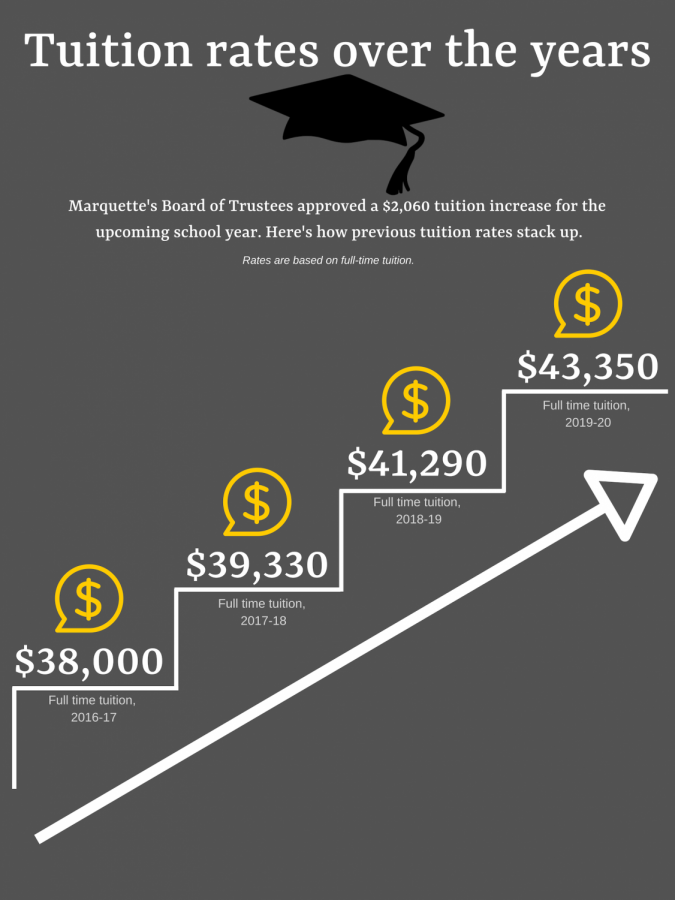

Students who are not financially dependent on their parents can apply based on their own income information. Despite tuition increases, Susan Teerink, associate vice provost for financial aid and enrollment services, said students will still receive financial aid. The last increase was announced fall 2018, increasing tuition by $2,060.

“Marquette commits to renewing the Marquette grants and scholarships a student received when they applied as a freshman,” Teerink said. “Reductions in need-based Marquette grants may occur as a result of a student no longer qualifying on the basis of financial need.”

Teerink said there are three main types of aid that Marquette students can receive from the FAFSA: Marquette-funded aid, state aid and federal aid.

Marquette-funded aid includes the Marquette grant and wages for campus employment. State aid is the most widely received aid and includes the Wisconsin Grant. Federal aid includes the Pell Grant, Federal Direct Stafford Loans and Federal Work Study.

“I think the grants are helpful because you don’t necessarily have to pay them back, but I think the interest rates can be high on student loans which can be difficult,” Webb said.

Amy Titus, a freshman in the College of Nursing, said almost half of her tuition is covered by her financial aid package and said she sat with her mom to fill out the FAFSA application together.

“I actually really like the FAFSA because my parents are divorced so my mom just has me on her taxes but I’m not on my dad’s taxes,” Titus said. “So it looks like my mom is just a single mom and I get a lot of money through that.”

However, Teerink said there can be some confusion with the FAFSA.

“I didn’t understand all of the terms,” Titus said.

She said the information to fill out about herself was easy and straightforward, but it can be hard when she isn’t sitting next to her parents for their information.

“When they fill out the FAFSA for the first time, parents enter their date of birth and social security numbers rather than the student’s,” Teerink said. “Other mistakes that could easily be avoided are with financial information. The FAFSA provides the opportunity for the student and their parents to have their financial information transferred directly from their tax returns on the IRS into their FAFSA. Some families choose not to use the transfer process and as a result enter incorrect information.”

Titus said some of her friends choose not to fill out the FAFSA because they do not believe it will help them if their parents have higher incomes.

“I think (it) is kind of a bummer because you could always try and at least get something,” Titus said. “But I know a lot of my friends don’t even bother with filling it out. I thought it kind of was an expectation for everyone to do it.”

While information about the FAFSA is available online on the FAFSA website and through Marquette’s financial aid office, Crystal Ibarra, a junior in the College of Business Administration, said she believes not all students know enough about their financial aid options.

Ibarra said she thinks the issues with FAFSA is that it isn’t always well known, so students who need it aren’t aware of their options.

“When my dad was growing up and going to school, he wasn’t aware that the FAFSA was a thing, which deterred him from going to college,” Ibarra said. “He went to trade school because that was the only thing he could afford.”

“We want as many students as possible to have a financial aid package in hand before they leave Marquette for the summer,” Teerink said. “We want students to be ready to start fall term and not worry about this while they are away from campus.”