U.S. student loan debt reached $1.56 trillion by the end of 2018, representing an increase of more than 130 percent from a decade ago, according to Federal Reserve data. This debt can be a significant drain on college graduates, inhibiting their ability to make major personal and financial decisions. Legislation must be passed to help graduates from Marquette and schools around the nation who suffer from student debt.

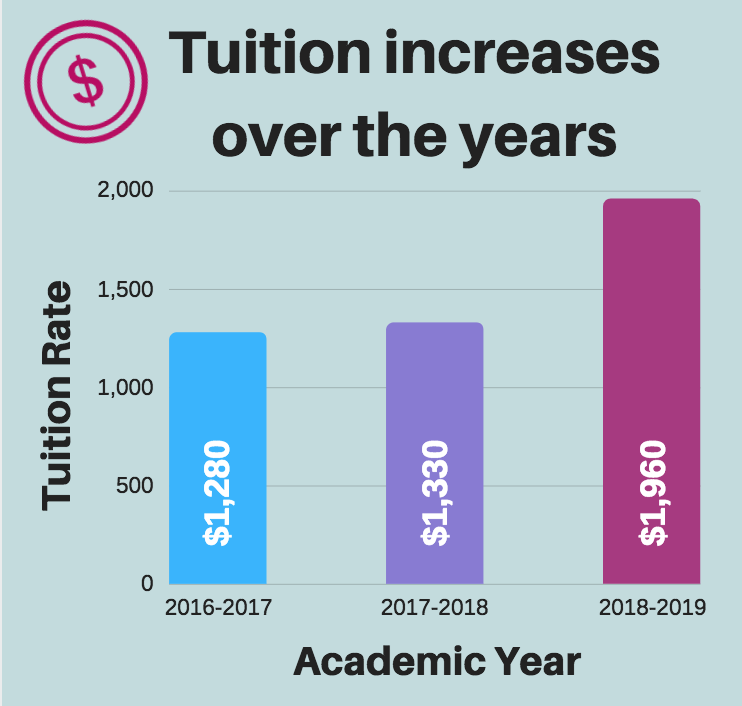

Marquette’s tuition increased to $43,350 for the 2019-’20 school year, representing the largest price increase in recent years. Many students are forced to take out loans to pay for the tuition that isn’t covered by grants or scholarships. About 60 percent of the Marquette’s class of 2017 had loan debt upon graduation, according to the Institute for College Access & Success. These borrowers had an average total debt of $37,713. This total was more than $9,000 higher than the national student loan debt average.

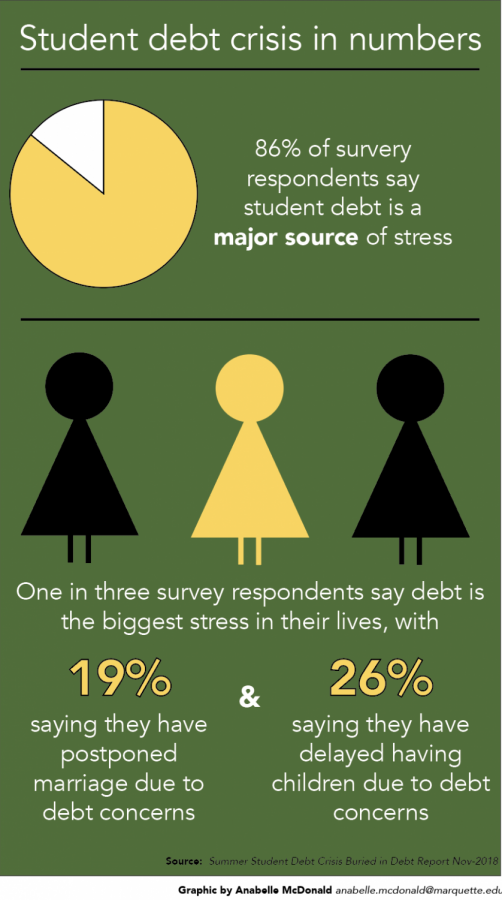

Unfortunately, this loan debt can have wide-ranging personal effects. A recent report by the nonprofit organization Student Debt Crisis surveyed adults with student debt across the nation. The report found that 86 percent of respondents said student debt is a major source of stress, and one in three said debt is the biggest stress in their lives. Additionally, 19 percent of these respondents have delayed getting married and 26 percent have postponed having kids due to concerns over debt.

This increased caution has extended to other major life choices, such as home ownership. Research from the Federal Reserve estimates that each $1,000 increase in student loan debt lowers the home ownership rate by about 1.5 percentage points for college graduates during their mid-20s. If student loans continue to inhibit major spending, the economic consequences could likely be disastrous.

Student loan debt has been able to increase so vastly because of the influence of special interests on our politics. Federal student loan services, such as the Navient Corporation, maintain control over legislators by spending millions of dollars on lobbying, according to a report from the Roosevelt Institute. Their report references a 2009 audit of Navient by the Department of Education, which found the corporation overcharged the federal government by $22.3 million, but Navient still hasn’t been required to repay the funds.

Thankfully, there’s legislative proposals to help graduates with their debt and hopefully give them more leverage against loan services. The Employer Participation in Repayment Act was reintroduced in the Senate last week with bipartisan support. The legislation would allow employers to contribute up to $5,200 tax-free annually to employees’ student loan debt payments. This would give graduates needed debt relief, as well as give employers a new tool to recruit highly educated job candidates.

Wisconsin Senate Democrats are still trying to pass the Higher Ed, Lower Debt bill. The bill would enable Wisconsin’s student loan borrowers to refinance their student loans at lower interest rates, deduct student loan payments from their income tax and provide students and parents with greater information about lenders. Passing the bill aims to increase in-state spending on cars, new homes and local businesses.

Finally, some legislation is being proposed to control future extravagant tuition increases. New York Rep. Tom Reed introduced the REDUCE Act last year, which would require colleges to make a long-term spending plan aimed at keeping tuition increases below the rate of inflation. Another provision would require universities to distribute 25 percent of endowment profits to students from working-class families.

Most Marquette students will have to start dealing with the reality of their exorbitant student debt in the near future. These students should contact their local representatives and show support for programs that will lessen their economic burden.