While the number of no-loan institutions increased in 2017, Marquette has not considered adopting the policy due to its current endowment size.

The policy allows qualified, low-income students to avoid borrowing money via loans.

Universities and colleges with this policy aim to cover families’ demonstrated financial needs based on information from the Free Application for Federal Student Aid and College Scholarship Service Profile, according to an article from Time Magazine.

No-loan institutions offer financial aid packages with grants – money not required to be paid back to the university – after taking into consideration work-study options and parental contributions.

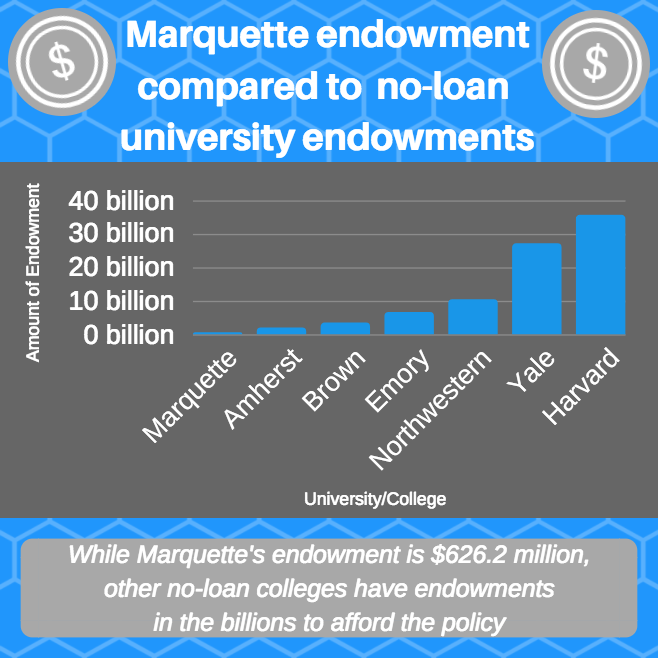

There are currently 32 no-loan institutions, including Brown, Northwestern, Harvard, Yale, Emory University and Amherst College.

Marquette’s protocol is to package direct student loans up to $5,500 for first-year students, as part of a financial aid package. In addition, students can receive Pere Marquette awards, grants and other scholarships as part of their package, John Baworowsky, vice provost for enrollment management, said.

Susan Teerink, director at the Office of Student Financial Aid, said the university does not have the tremendous amount of resources and support to make a no-loan policy feasible. In comparison, she said current no-loan institutions have substantial endowments.

“While our endowment continues to grow, it is not feasible for us to be a no-loan (institution) at the endowment’s current size. We understand that a college education is a significant investment for our students and their families and requires sacrifices for many of them,” university spokesperson Brian Dorrington said in an email.

Despite no-loan policies, students at no-loan institutions can still take out loans. For example, at Columbia University – a no-loan institution – 26 percent of students still take out student loans, according to Time Magazine.

Although Marquette is not a no-loan university, Baworowsky acknowledged that there are benefits to the policy. Graduating without debt to pay when entering the workforce can be an advantage, he said. However, he also said borrowing money for an education can be a good investment.

“I do not personally see a disadvantage to not being a no-loan university,” Baworowsky said. “Marquette in particular is a good investment because we provide a superior education, excellent placement into graduate school and effective career placement services … we have a substantial scholarship and grant program that makes a Marquette education affordable.”

Marquette Central works with students before they enter Marquette and as they continue their education to assist them in taking advantage of available resources to help meet their financial needs.

“Fortunately, we have the support of generous philanthropic partners: Our many alumni, parents, friends and supporters at corporations and foundations who help us make up the gap,” Dorrington said.