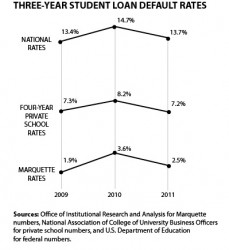

Marquette’s student loan default rate saw a slight decrease last year, mirroring a 1 percent decrease in the national average for student loan defaults, according to data from the Department of Education.

The university’s most recent three-year average loan default rate came in at 2.5 percent for 2011 according to the National Student Loan Data System, meaning that only a small minority of Marquette students who began paying their loans in 2011 could not make their payments.

This number marks a dip from the previous rate of 3.6 percent, but that’s well below the national three-year default average of 13.7 percent, which fell from 14.7 percent the previous year.

Even in comparison to the average student loan default rate of 7.2 percent for private, non-profit universities, Marquette’s rate is still significantly smaller. That means Marquette also avoids government sanctions for student loan default rates greater than 30 percent. These sanctions do not allow offending colleges to participate in federal student aid programs.

A defaulted loan can be rehabilitated one time with the completion of a loan rehabilitation agreement that the office then approves. The benefits of this option are that the loan is returned to normal status, the defaulted payment is removed from the borrower’s credit history and the borrower regains the benefits of the initial loan.

According to a Forbes article, default rates are based on the number of students who have defaulted on at least one student loan three years after college. When a student fails to make payment on a loan after 270 days, that student has defaulted on a loan. Beyond just a lack of financial literacy, default can happen due to a failure to graduate from college or the inability to find employment post-graduation.

Leaving college prior to graduation leads to a lower chance of finding employment and consequently means a lack of money to pay back loans, similar to how not finding post-graduation employment creates student loan defaults. For that reason, a low default rate is evidence of a high graduation rate, as well as finding employment following graduation.

Still, that doesn’t mean Marquette students aren’t intimidated by the daunting debt that can pile up while attending the school.

“I think the interest rates on students loans are quite high, placing a greater burden on students after they graduate,” said Jenny Garbarz, a junior in the College of Arts & Sciences. “I am mildly scared for student loans.”

Marquette offers loan assistance for students through the Office of Student Loan Accounts and Collections, and offers advice to students having difficulty making payments.