Marquette Student Government unanimously passed a resolution Thursday outlining recommendations on a Marquette proposal to implement a student health insurance requirement.

The resolution was passed in anticipation of a potential university-wide change to the health insurance policy that would require all students to have health insurance.

Executive Director of the Student Health Service Carolyn Smith, who spoke at Thursday’s MUSG meeting, said the proposed mandate would institute a hard waiver model that would require students to provide proof of insurance in order to opt out of the university plan.

Smith said the Board of Trustees will vote on the the health insurance mandate at its semiannual meeting in December, with the implementation of the requirement expected as early as fall 2013. She said she expects the board to approve the proposal.

“I think the board recognizes that health and safety and wellness of our students is our utmost priority,” she said. “Most of our peer institutions are going this way, so I do think that it’s highly likely that they are going to approve it.”

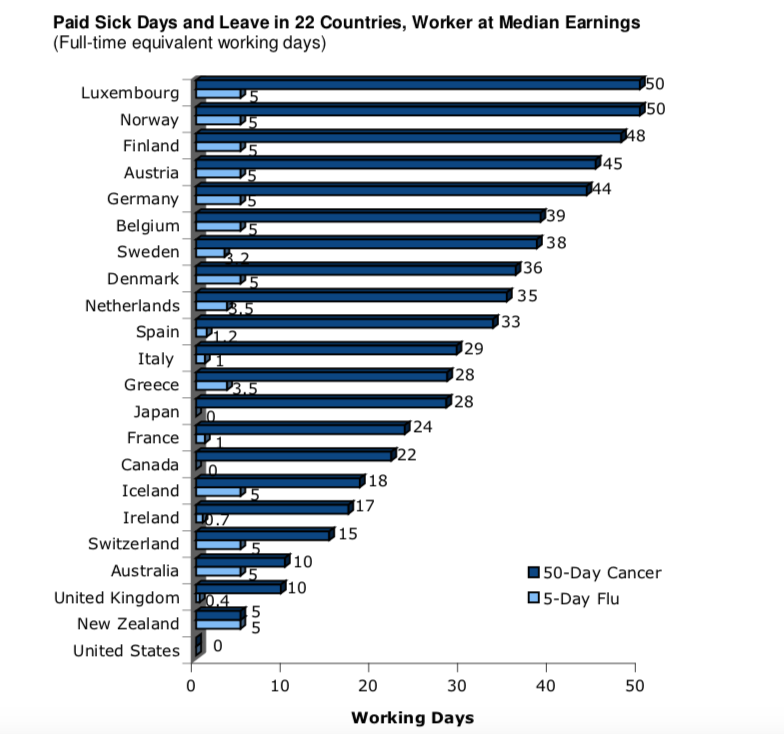

In accordance with the 2010 Affordable Care Act, all American citizens will be required to have health insurance by 2014. Therefore, Smith said, Marquette’s proposed insurance mandate would offer students an alternative to the federal government’s health plan.

Smith said the requirement would mostly impact the 5.6 percent of students who are not currently insured. Unless those students are added to their parents’ insurance or purchase their own plan, they will be expected to pay an estimated $2,300 to $2,500 for the university’s health plan.

Drew Halunen, a senior in the College of Arts & Sciences and a former candidate for the MUSG presidency, is one of those approximately 650 uninsured students. He said he has mixed feelings about the possible health insurance requirement.

“It does not bother me that much because I know, in 2014, I’m going to need to have (health insurance) anyway,” Halunen said. “But I guess I do not really understand why the university brought this issue up now.”

MUSG had four specific requests for the administrators in the resolution it passed Thursday, two of which deal with the cost of the program. The other two address issues of how the university will communicate its plans for implementation if the proposal passes the Board of Trustees.

MUSG Senator Thomas Schick, a sophomore in the College of Arts & Sciences, is one of the authors of the resolution.

“Obviously the issue at hand is quite political, but when MUSG was writing this, all we were doing was speaking on behalf of the students,” Schick said. “We were not endorsing anything either way.”

The legislation first asks that the university “recognizes the unique financial situations of each student in determining the expense of the program and provide affordable premiums for low-income students.”

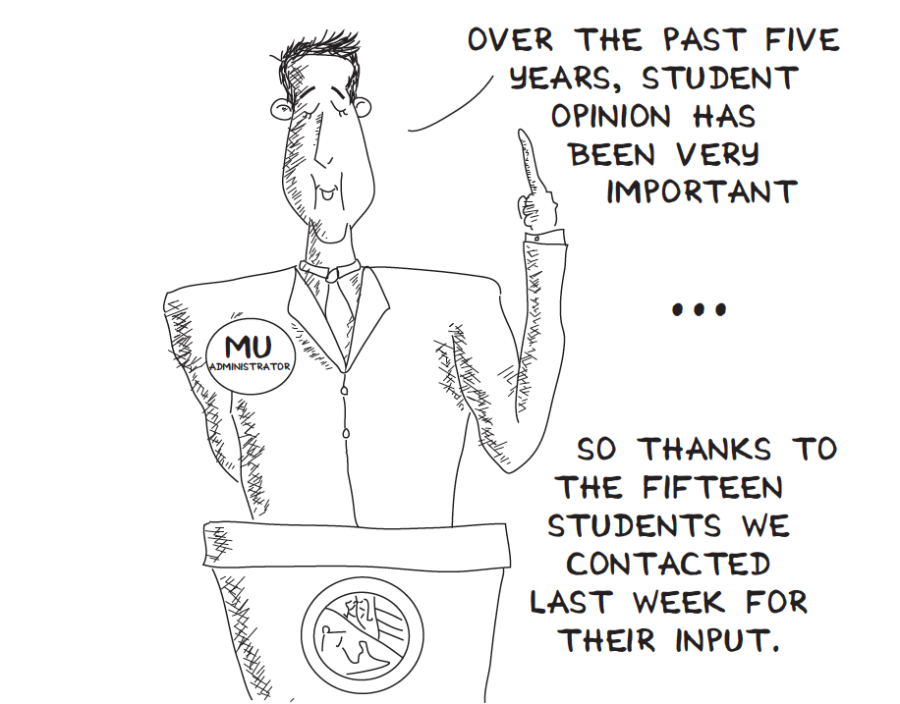

The next request outlined in the resolution “calls for the university to remain transparent throughout the adoption of this new program by communicating significant changes to the direction of the policy.”

Finally, MUSG recommends the administration implement a plan for “communicating the requirements, process and other intricacies relating to the administration of the new health care policy to the student body.”

Smith said she plans to take MUSG’s opinion into account throughout the process, since the program will directly impact students.

“The cost we’re going to negotiate as low as we can,” she said. “But obviously there are barriers that we can’t control with that. Regarding transparency, I intend to go back to MUSG if and when it’s approved and again with what our final implementation plans are.”

The primary way the university would keep insurance costs low is by making the charge another item on students’ CheckMarq receipts, Smith said. That way, students will be able to pay for insurance with their financial aid. Additionally, she said the administration is working to provide a health care scholarship for students in need.

Smith said premiums would drop if more students decide to buy into the program.

“You can leverage those numbers with the vendor and say, ‘We’re going to have approximately X number of students enrolled in this plan,’” she said. “So it just gives you more leverage to bring down the premium costs, because the risk pool increases in size but decreases in risk.”

Vice President of Student Affairs L. Christopher Miller, who also spoke at Thursday’s meeting, said the university will offer an “excellent plan” that should have no problem attracting students.

“There may be students that will opt for this plan instead of their parents’, especially those that may end up having a pre-existing condition that could, in fact, be tacked on,” he said.

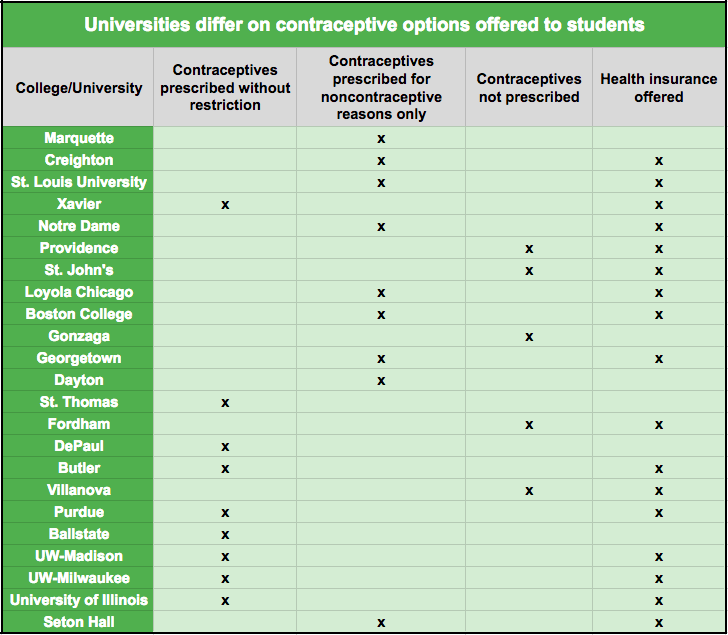

Some provisions of the plan include uncapped prescription coverage and contraceptive coverage in accordance with the Affordable Care Act. Additionally, the plan will be available to Marquette students of all ages in undergraduate, graduate and professional studies, regardless of marital status.

As Smith indicated, 18 of the nation’s 28 Jesuit universities currently have a health insurance requirement, and 80 percent of all private institutions have such a mandate. Smith said only 60 percent of public colleges have an insurance requirement and that the University of Wisconsin system is looking into establishing a similar program.