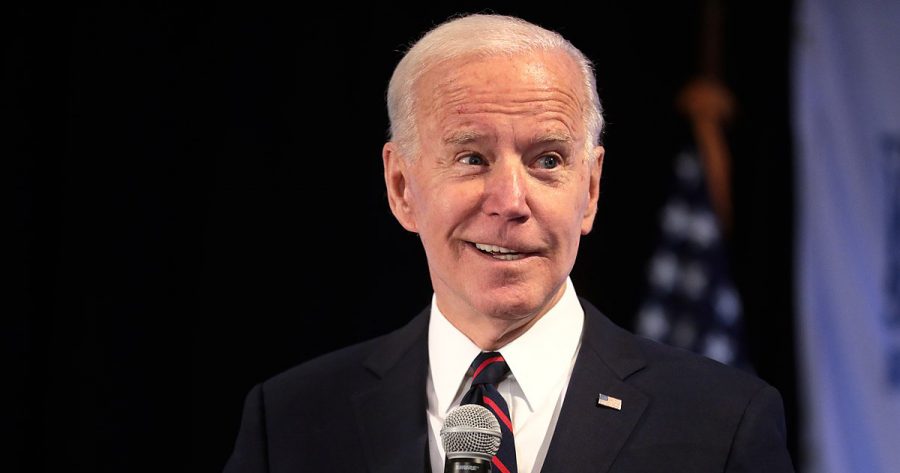

One theme President Joe Biden ran on in his 2020 presidential campaign was working to cancel student loans and create better relief programs for those with federal loans.

In working to fulfill his campaign promise, Aug. 24, 2022, Biden announced a plan to forgive up to $10,000 of student debt for those who fell within a certain income threshold. Those with Pell Grants will receive an additional $10,000 in student loan cancellation.

The possibility of student loan forgiveness remained short-lived after six Republican-led states filed a lawsuit against the program and stated that only Congress has the authority to forgive student loans. This jeopardized some borrowers regarding the balance of their debt going forward.

“I was initially excited about the forgiveness plan that the Biden administration laid out for borrower like me. It would allow for me to focus more on saving for the future and less about paying down my existing balance,” Abd-Alrahman Rabeeh-Musaitif, a recent college graduate from the University of Wisconsin- Milwaukee, said.

The current plan by the Biden administration is now under pause as it is currently being heard in the courts. For the past few months, the hearing has been occurring in the lower courts until Feb. 28 when the Supreme Court of the United States heard the augments for Biden v. Nebraska and U.S. Department of Education v. Brown — two cases that question whether the Department of Education has the legal right to forgive student loan debt.

“The Biden Administration is claiming that a 2003 Congressional statute, the HEROS Act applies to this situation and that the original purpose of this act was to allow the executive branch to forgive student loans of military personnel who would be serving overseas,” Paul Nolette, a professor in the department of political science, said.

Abdallah Qasem, a sophomore in the College of Health Sciences, said it would be nice if the administration worked to also lower the cost of higher education because it can lead to less of a crisis in the future. He sees this as a good start for current borrowers and has hope for the future.

“I’m hoping that it allows for future debt relief, specifically with graduate debt. I expect to take out a six-figure amount in loans to finance my education in the future, so knowing that there can be some relief in the future would be nice,” Qasem said.

Nolette said the Biden administration has used the act to present that it can be applied in other emergency situations, such as COVID-19, that student loan borrowers were involved over the past years.

“If the hearings go in the way the Biden administration hopes, it would give the president broad power to forgive loans even if Congress hasn’t explicitly given authorization for that action. Not only would it affect those who currently have debt, but it could open the door five or ten years from now for a future president to do something similar,” Nolette said.

Nolette said if Biden’s plan doesn’t go as intended, giving broad student debt forgiveness can become difficult going forward. Congress would need to approve forgiving these debts. Nolette said if Biden is unsuccessful, it will be difficult for him to continue working to forgive education debt and enact similar policies.

“With Congress so polarized over these issues, particularly with Republicans in control of the House of Representatives, it is very unlikely that student loan debt would pass Congress and get to Biden’s desk to sign,” Nolette said.

The expected cost of the program is to be $373 billion and helps around 43 million borrowers. Additionally, some economists have found that forgiveness will not lead to an increase in inflation due to the plan being spread out over the balance of the loan, but will bring an increase in consumer spending.

“The Justices seem quite skeptical of the Biden plan. If I was forced to make a prediction here, they are like to strike down the Biden administration’s action here, but we’ll have to see until June when the decision comes out,” Nolette said.

Nolette said the court’s ruling would not affect the Public Service Loan Forgiveness – a program designed to forgive those after 10 years of service in government and most non-profit organizations. The only way to remove the program is through an act of Congress.

“Though this plan is potentially costly for the government, it can work to bring about change for others. People will have more money in their pockets and education debt will not hold back people from living better lives,” Qasem said.

Marquette University has set up a site to help navigate graduates and students through the Student Debt Relief Plan process. Additionally, student loan payments will remain paused until June 2023, when the expected decision of the Supreme Court is to come out.

This story was written by Uzair Qhavi. He can be reached at uzair.qhavi@marquette.edu.